An “One Cancels the Other” (OCO) order is a type of order where two orders are created at the same time..

An “One Cancels the Other” (OCO) order is a type of order where two orders are created at the same time, but only one can be executed. This means that as soon as one of the orders is filled, the other one will be automatically canceled. OCO orders may also be referred to as Order Cancels Order.

An OCO order is a form of trade automation that combines a limit order with a stop-limit order. This makes it a powerful tool for traders looking to increase their success rates and minimize potential losses. With an OCO order, you can place two limit orders simultaneously. For example, you can create an OCO order that either buys on a resistance breakout (above a certain price) or buys if the price drops to a specific support level.

It’s important to note that if one of the orders is executed, the other will be automatically canceled. Therefore, depending on the situation, you may want to place a new order after your OCO order is triggered.

In summary, OCO orders are a secure way to trade by locking in potential profits or limiting risks. They also provide versatility by allowing you to enter or exit positions without having to choose between a bullish or bearish bias. OCO orders are especially useful for traders who don’t want to track the market activity on a daily basis.

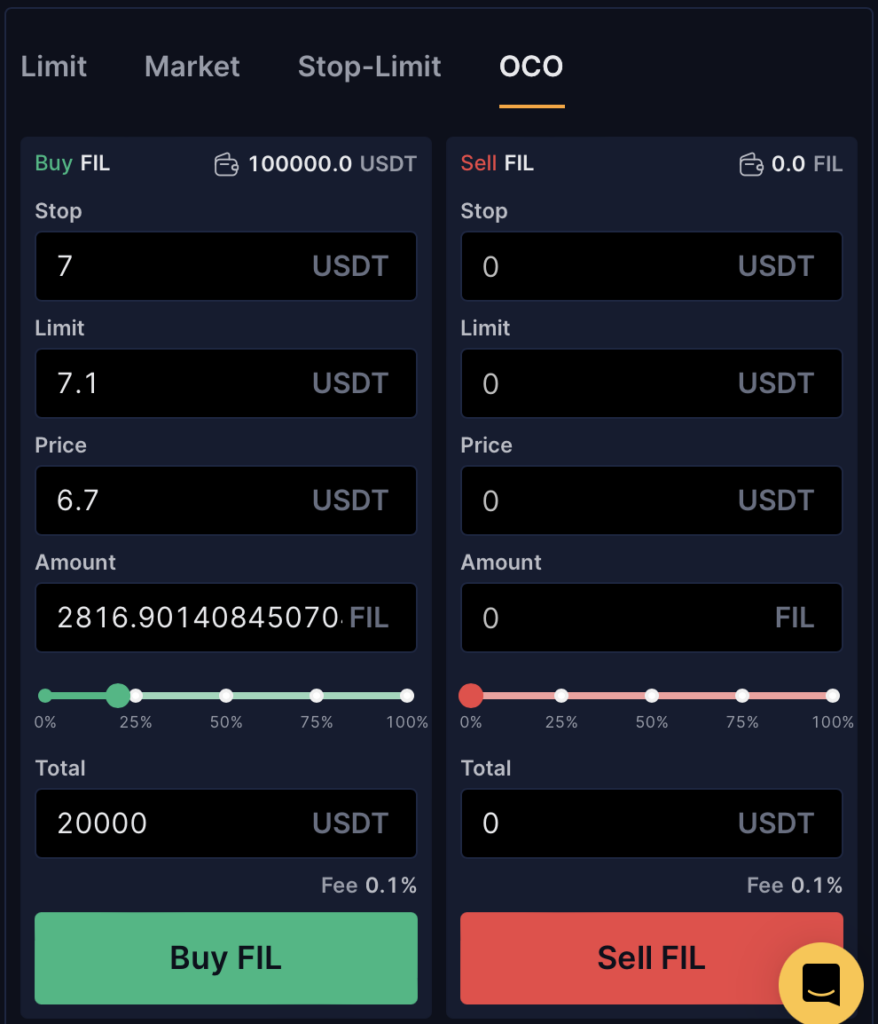

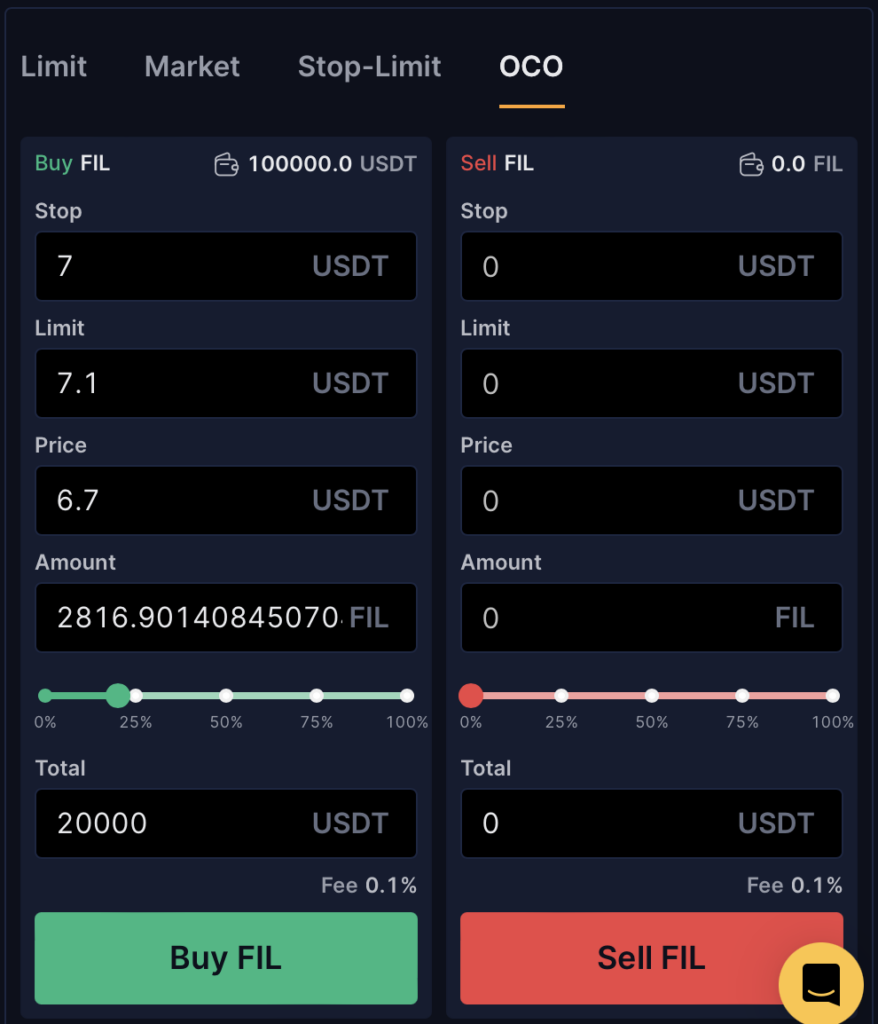

OCO Buy Order Example

For example, FIL is trading at $6.9, so you should set the buy-limit order “price” below the current price, the stop-limit order, “limit” and “stop” above the current price.

So the stop-limit order will be triggered when the price goes up to $7, and the buy-limit order “price” will be canceled simultaneously. However, if the price drops to $6.7 or below the buy-limit order will be executed automatically and the stop-limit order will be canceled.

OCO Sell Order Example

For example, FIL is trading at $6.9, so you should set the sell-limit order “price” above the current price (known as take profit price), the stop-limit order, “limit” and “stop” below the current price (known as stop-loss).

So the stop-limit order will be triggered when the price drops down to $6.6, and the sell-limit order “price” will be canceled simultaneously. However, if the price goes up to $8 or above the sell-limit order will be executed automatically and the stop-limit order will be canceled.

Leave a Reply